View historical precious metals price charts »

View historical precious metals price charts »

- September 14, 2020 -

By Douglas Trinder, Senior Numismatist & Precious Metals Analyst, Jack Hunt Gold & Silver

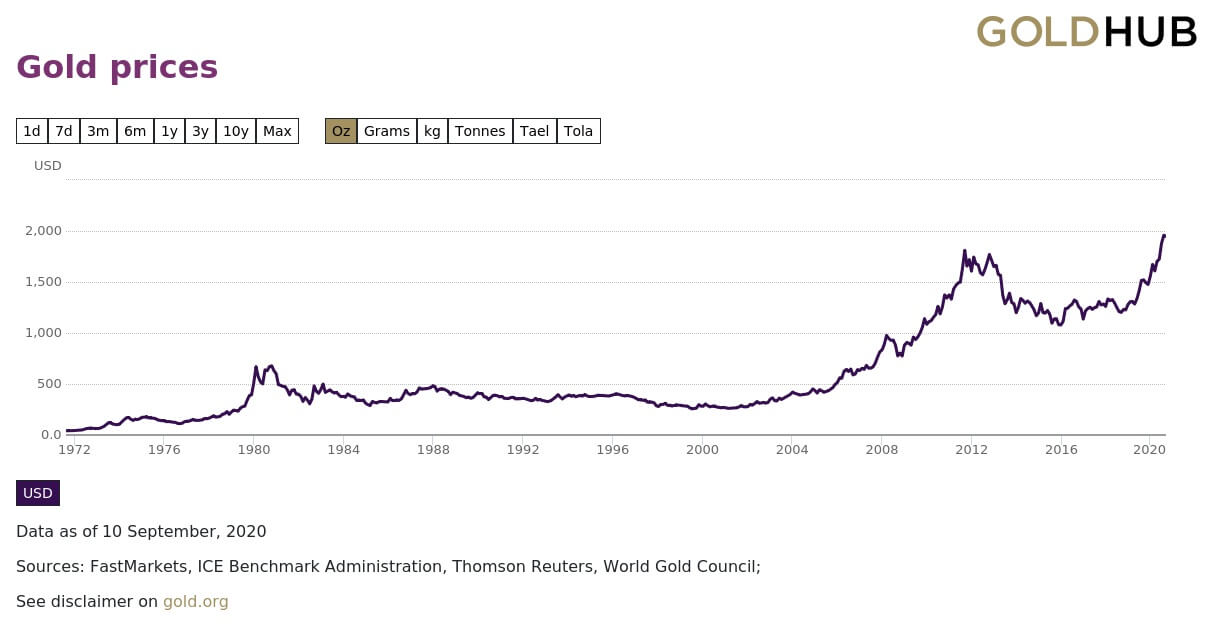

Since President Nixon’s abandonment of the Bretton Woods System in August of 1971 the price of gold in US Dollars has been allowed to fluctuate from its previously set price of $35.00 per troy ounce. Since 1971 there have been both extended periods of gold price stability as well as several instances of rapid price increases or ‘spikes’. This article will examine three of the more noteworthy gold price spikes.

Since President Nixon’s abandonment of the Bretton Woods System in August of 1971 the price of gold in US Dollars has been allowed to fluctuate from its previously set price of $35.00 per troy ounce. Since 1971 there have been both extended periods of gold price stability as well as several instances of rapid price increases or ‘spikes’. This article will examine three of the more noteworthy gold price spikes.

The most highly publicized gold rally occurred in 1979-80. Often referred to as the ‘boom’, gold rose from $230.00 an ounce in January of 1979 to a then staggering level of $855.00 an ounce in January of 1980. With silver reaching its still all-time high of $48.00 an ounce at the same time, media coverage was extensive. Fly-by-night gold and silver buyers suddenly appeared in what seemed to be every vacant storefront. The amount of gold jewelry, sterling and coins sold by the public was at levels never to be seen again. However, the ‘boom’ was short lived and effectively ended in the Summer of 1980. By June of 1982 gold was below $300.00 an ounce again. The gold price spike of 1979-80 is thought by many to be a classic reaction to high interest rate, high inflation rate during the latter stages of the Jimmy Carter presidential tenure. When it became apparent that Ronald Reagan and his conservative fiscal policies would assume the presidency in 1981, inflation fears eased resulting in gold’s price regression.

From 1982 to 2006 the price of gold was valued in a rather narrow range of $255.00 to $530.00 an ounce. In 2007 gold began a noteworthy ascent in value hitting $1000.00 an ounce in March of 2008 and breaking the $1000.00 barrier for good in October 2009. In July of 2010, the gold price averaged $1050.00 an ounce, one year later it hit $1600.00 and peaked two months later at $1900.00. This price spike garnered some media attention and many of the fly-by-night ‘We Buy Gold’ businesses, closed since the mid ’80’s, popped up again. This gold price spike, unlike 1980, featured far more bullion transactions and less selling of jewelry and the like. Many of those who had accumulated bullion over the prior 25 years sold some or all of their holdings at a handsome profit. Others, thinking precious metals were heading to even more astronomical heights, bought in at these then relatively high levels. Unfortunately, by 2013 gold had retreated to below $1200.00 and remained rangebound till 2020. Most observers feel gold’s regression from its 2011 highs was likely due to three reasons: 1) Profit taking 2) Lessening of demand due to the then unheard of $1900.00 price level and 3) Low Fed Fund (Interest) rates from 2010 to 2016.

The third and final gold price spike to be discussed is still ongoing. In August of 2019 gold averaged $1400.00 an ounce. Exactly one year later it hit an all-time high of $2065.00 an ounce. As I write this gold seems ‘comfortable’ trading in the $1900.00 range. Unlike the other price spikes of 1980 and 2011, the meteoric rise of gold this year has been largely ignored by the media. Why? Theories are numerous. Is it due to the volume of ‘more important’ legitimate or imagined news we’ve been bombarded with this year? Is the Federal Reserve or Wall Street suppressing information? We may never know.

The third and final gold price spike to be discussed is still ongoing. In August of 2019 gold averaged $1400.00 an ounce. Exactly one year later it hit an all-time high of $2065.00 an ounce. As I write this gold seems ‘comfortable’ trading in the $1900.00 range. Unlike the other price spikes of 1980 and 2011, the meteoric rise of gold this year has been largely ignored by the media. Why? Theories are numerous. Is it due to the volume of ‘more important’ legitimate or imagined news we’ve been bombarded with this year? Is the Federal Reserve or Wall Street suppressing information? We may never know.

While the amounts of scrap gold and coin collections sold this year have been minimal, the volume of bullion related transactions has been extraordinary. This year has seen such intense demand for tangible precious metals that shortages in gold and silver bullion have been commonplace.

Where gold goes from here is purely speculative. Interest rates are effectively as low as they can go but the Fed could create more money out of thin air in response to the current pandemic. If that occurs the dollar should theoretically weaken versus foreign currencies, a scenario usually bullish for gold. A Democratic victory in November would likely give at least a temporary boost to the gold price as well. On the other hand, if the pandemic and its related issues ease, or a successful COVID-19 vaccine becomes available to the masses, a regression in the gold price back to pre-COVID levels seems likely.

Regardless if you think gold is rocketing towards $3000.00 an ounce or regressing back to $1500.00, I’d like to conclude by suggesting you talk to the professionals at Jack Hunt Gold and Silver for all of precious metal related transactions.